Some associated with the top worldwide macro managers that are in red in 2010 are Moore worldwide, Fortress Macro, Discovery international and Eclectica Fund. Paul Tudor Jones’ Tudor B.V.I worldwide normally scraping by with a -0.6per cent return YTD through September 12.

Some associated with the top worldwide macro managers that are in red in 2010 are Moore worldwide, Fortress Macro, Discovery international and Eclectica Fund. Paul Tudor Jones’ Tudor B.V.I worldwide normally scraping by with a -0.6per cent return YTD through September 12.

Fortress, Brevan Howard down

Michael Novogratz and Jeffrey Feig’s Fortress Macro Fund is down 4.3percent for the 12 months through Sept. 12. Fortress Macro had been down 2.3percent in August alone as the wagers on increasing interest levels failed. Relating to Bloomberg, the investment was quick USTs and German bunds, wagers that couldn't make money in that period.

Brevan Howard‘s flagship global macro strategy is not doing much better. After a 0.1per cent reduction in August, the $26 billion investment is down 3.8% for the 12 months. Brevan Howard mainly invests in bonds and forex areas. The fund suffered its optimum drawdown of -8.5per cent between April 2013-June 2014. While Brevan Howard boasts accurate documentation of never having a losing 12 months since 2002, the investment has additionally didn't beat the marketplace during the last few years.

Worldwide macro funds record outflows

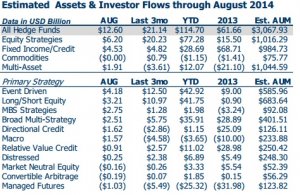

Relating to eVestment’s monthly asset circulation report, macro hedge funds welcomed $1.57 billion into the thirty days of August. The strategy manages $233 billion, and contains to date suffered outflows of $3.65 billion in 2014. This makes it the two techniques which have experienced web outflows in 2010.

Tiger Cub Rob Citrone’s Discovery worldwide investment is sitting on a loss in 11.8per cent YTD through September 12. Discovery’s bets on technology brands and short pants in growing areas have now been the main cause of losings this current year. Louis Bacon’s Moore Global had been down 5per cent at the end of August whereas the Moore Macro Managers had been up 1.2per cent YTD.

Losers today, champions tomorrow?

There were forecasts that the macro managers who are enduring today will likely to be compensated whenever central finance companies place the brake system on financial stimulus. Morgan Creek’s Mark Yusko states that smart-money supervisors are moving their money in these underperforming resources since this is where money will maximize in the next a year.

Of note, smaller macro resources aren't performing much better. Hugh Hendry’s Eclectica Macro Fund ended up being down 1.2% in August, enhancing the complete reduction when it comes to 12 months to -10.9per cent. Eclectica had been down on its long wagers in developed markets, especially Europe and Japan. In an investor page, Hendry commented on the policy changes in Europe,

“With European stock prices down over 10percent through the summertime, the central bank eased plan quite a bit and stock prices are rising yet again. Obviously this marks a monumental change in Europe: the as soon as austere German structured central bank has actually jettisoned its custom and is explicitly concentrating on higher prices.”

London-based TT International‘s worldwide macro strategy is down 6.3per cent for the 12 months after a 1.27per cent loss in August. Rubicon Global was up 13percent in the first twelve days of this month which slashed its complete reduction to -17% when it comes to year. Mount Lucas Management’s MLM Macro had a 1.9percent return in August, getting its annual reduction to -2percent. Relating to HSBC Hedge Weekly, the investment has returned up 3.1percent after getting 5.3per cent in the 1st a couple of weeks of September.

YOU MIGHT ALSO LIKE